( continued )

What else explains Congressional Republicans refusal to pass a bill that gives tax breaks to companies hiring at home while eliminating tax breaks for companies shipping jobs overseas?

GOP senators block Dem ‘insourcing’ bill

By Ramsey Cox - 07/19/12 02:39 PM ET

Senate Republicans on Thursday blocked an "insourcing" bill from Democrats that would have ended tax breaks for companies that move jobs overseas.

The Bring Jobs Home Act also would have given a tax incentives to companies that bring jobs back to the United States. The measure failed to advance on a 56-42 vote, with 60 votes needed to end debate on the bill.

Earlier in the week, Republicans also blocked the Disclose Act, which would have required the disclosure of campaign contributions of more than $10,000.

What else explains keeping the American Jobs Act blocked for over a year?

The method Republicans have used to block all jobs legislation in the past two years is the same. A jobs bill comes up, it is filled with positive things for the economy, Republicans filibuster debate, this shields them from having to make floor speeches on why they don't want tax breaks for small businesses... etc.

Why? Well, if the economy recovers too strongly before an election, Republicans will lose power. If jobs numbers look too good, people will want to keep the same party. By Republicans blocking all jobs legislation and keeping jobs numbers from improving they believe this is their ticket to power.

In other words, if you and other Americans suffer just long enough it will pay off for Republicans.

They sacrifice the citizens' jobs with the hopes that they will create more Republican jobs in Congress.

What else explains their taking the debt ceiling hostage, further endangering our economy and standing in the world?

For if we hit the debt ceiling, the government will be forced to stop paying roughly a third of its bills, because that’s the share of spending currently financed by borrowing. So will it stop sending out Social Security checks? Will it stop paying doctors and hospitals that treat Medicare patients? Will it stop paying the contractors supplying fuel and munitions to our military? Or will it stop paying interest on the debt?

Don’t say “none of the above.” As I’ve written before, the federal government is basically an insurance company with an army, so I’ve just described all the major components of federal spending. At least one, and probably several, of these components will face payment stoppages if federal borrowing is cut off.

And what would such payment stops do to the economy? Nothing good. Consumer spending would probably crash, as nervous seniors started wondering how to pay for rent and food. Businesses that depend on government purchases would slash payrolls and cancel investments.

Furthermore, markets might well panic, especially if interest payments are missed. And the consequences of undermining faith in U.S. debt might be especially severe because that debt plays a crucial role in many financial transactions.

What else explains their refusal to stop subsidizing big oil's obscene profits?

Exxon Mobil’s Tax Rate Drops To 13 Percent, After Making 35 Percent More Profits On Rising Gas Prices In 2011

By Rebecca Leber on Mar 26, 2012 at 6:13 pm

Exxon Mobil, the most profitable of the big five oil companies, made $41.1 billion in profits last year. Although Exxon made 35 percent more profits since 2010, its estimated effective tax rate actually dropped. Citizens for Tax Justice reported Exxon paid only 17.6 percent taxes in 2010, lower than the average American, and a Reuters analysis using the same criteria estimates that Exxon will pay only 13 percent in effective taxes for 2011. Exxon paid zero taxes to the federal government in 2009.

Reuters compares the 45 percent tax rate Exxon claims it pays to the effective rate estimated by Citizens for Tax Justice — a rate that’s even lower than Mitt Romney’s tax rate. Chevron, which made $26.9 billion profit in 2011, paid 19 percent:

Citizens for Tax Justice considers U.S. profits and U.S. taxes paid only. By that measure, Exxon Mobil paid 13 percent of its U.S. income in taxes after deductions and benefits in 2011, according to a Reuters calculation of securities filings.

It is a far cry from the 35 percent top corporate tax rate.

Still, the three-year average for telecom companies is 8 percent; for information technology services companies, it is 2.5 percent, according to CTJ.

What else explains Mitt Romney's chief energy adviser Harold Hamm's testimony during a Congressional hearing?

In a congressional hearing Thursday, Continental Resources CEO and Mitt Romney’s chief energy adviser Harold Hamm asked to preserve the oil industry’s billions in tax breaks, although his company pays little in federal taxes. The oil firm has earned more than $1.8 billion profit over five years by dominating the oil shale boom in North Dakota.

In his prepared testimony, Hamm defends tax breaks by pointing to his own company, saying, “Continental’s effective tax rate is 38%!” But according to Citizens for Tax Justice, Continental paid an average 2.2 percent tax rate, or $40 million, over five years.

Hamm claims a higher tax rate by including deferred taxes the company hasn’t paid. It’s a popular tactic, used by oil companies and the American Petroleum Institute. CTJ shows that Continental Resources has paid federal income taxes as low as 0.1 percent in the last five years:

What else explains Senate Republicans defeating a bill that would help our sons and daughters returning home from war to an unemployment rate for Iraq and Afghanistan Veterans at 12.7% — more than 4 percentage points higher than the national average?

G.O.P. Blocks Veteran Jobs Bill

By LAWRENCE DOWNES

Veterans won’t be getting a new, billion-dollar jobs program, not from this Senate. Republicans on Wednesday afternoon blocked a vote on the Veterans Job Corps Bill after Jeff Sessions of Alabama raised a point of order — he said the bill violated a cap on spending agreed to by Congress last year. The bill’s sponsor, Patty Murray of Washington, said that shouldn’t matter, since the bill’s cost was fully offset by new revenues. She said Mr. Sessions and his party colleagues had been furiously generating excuses to oppose the bill, and were now exploiting a technicality to deny thousands of veterans a shot at getting hired as police officers, firefighters and parks workers, among other things.

The vote was 58-40; the bill needed 60 votes to proceed.

It would be easier to admire the Republicans’ late-breaking fiscal scrupulosity if their motives — denying the Obama administration any kind of victory this year, whatever the cost to jobless vets — weren’t so transparent. It’s probably useful to remind Republicans like John McCain (a “nay” on the jobs bill) that wounded, jobless and homeless veterans aren’t a fact of nature. They’re a product of the wars that Congress members voted for, the war debt they piled on, and the economy they helped ruin.

“It’s unbelievable that even after more than a decade of war, many Republicans still will not acknowledge that the treatment of our veterans is a cost of war,” Ms. Murray said in a statement after the vote.

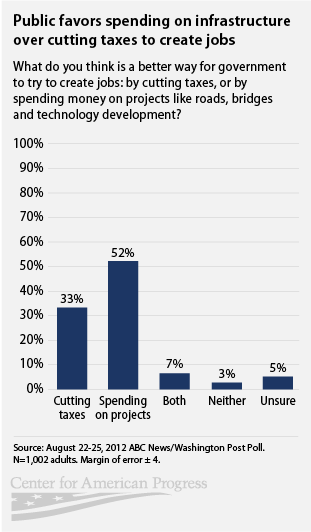

This does -

And so does this

How can Congressional Republican actions be described as anything but un-american? How can their actions be seen as anything but abusive to the very people they have sworn to serve?

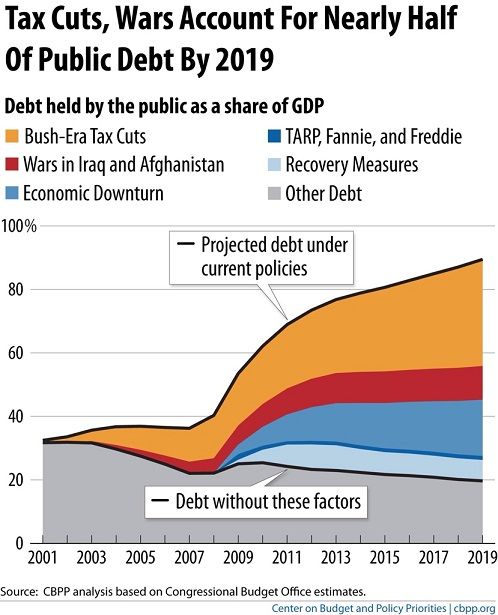

And that debt that they all say they're so very, very, worried about? Not really.

They created most of it in the first place, after all. It didn't matter to them when they voted to keep two wars off the books, give tax breaks to the fortunate few, or broke the economỵ

It doesn't really matter to them now. The debt is just another weapon used to harm President Obama's re-election. In the Republican equation of what it takes to achieve and hold political power, that their hostage taking of the debt ceiling harms the American people is not a bug, it's a feature. The pain given to average Americans by Republican votes against jobs or raising the debt ceiling or anything else is the desired result.

It's all woven of the same arrogant ignorance, disdain, and unconcern voiced by the Republican candidate for the Presidency, "I don't care about the poor," Mitt Romney.

Indeed. Or the unemployed, seniors, the disabled, the hungry, our Veterans, our businesses on Main Street or our history as a Nation.

Today's Republicans have turned their backs on the lessons learned by the generation that returned home from battle fields in Europe and Asia after World War II. That "Greatest Generation" is so named, in part, because they went on to build the greatest economy the world had known.

They were the good guys who saved the world from fascism and then turned around and rebuilt the countries they had defeated. They created the greatest economy known to man - one based on values of shared sacrifice and reward. They believed that progress stemmed from our collective efforts, not from narrow interest-group wrangling or the Ayn Rand go-it-alone playbook.

The Greatest Generation became who they are, not alone, but with government programs that paid for education, job training, and housing. Together they created the largest expansion of the middle class in history. Our people and government working together made manifest the American Dream that future generations inherited and built upon.

Today's Republicans are destroying that dream. They are betraying what the Greatest Generation and its heirs fought so hard to build and safeguard - all in the name of political expediency.

Four of the Republican Senators who voted today against the Veterans' Job Corps Act helped write it. It was a bipartisan bill, until it was time to vote during a Presidential Election.

There is no arithmetic that makes sense, nor virtue to be found in what they are doing.

As President Clinton said, none of it adds up. Just do the math.

9:37 PM PT: There is another Greatest Generation, a generation of Civil Rights leaders that risked it all to make life better for All of America's people. Those rights so dearly paid for are under attack. blue jersey mom has written a powerful diary honoring them and what we need to do to ensure that the rights they fought and died for are not lost.

http://www.dailykos.com/story/2012/0...er-Suppression

Thu Sep 20, 2012 at 2:17 AM PT: These are the 40 Republican Senators who voted against the Veterans' Job Corps Act, among other things.

(Side note: Since the pix doesn't show up, here is the list of 40 Republicans who voted against Veterans' Job Corps Act and thereby effectively keep America's veterans unemployed:

Alexander (R-TN)

Ayotte (R-NH)

Barrasso (R-WY)

Blunt (R-MO)

Boozman (R-AR)

Burr (R-NC)

Chambliss (R-GA)

Coats (R-IN)

Coburn (R-OK)

Cochran (R-MS)

Corker (R-TN)

Cornyn (R-TX)

Crapo (R-ID)

DeMint (R-SC)

Enzi (R-WY)

Graham (R-SC)

Grassley (R-IA)

Hatch (R-UT)

Hoeven (R-ND)

Hutchinson (R-TX)

Isakson (R-GA)

Johanns (R-NE)

Johnson (R-WI)

Kyl (R-AZ)

Lee (R-UT)

Lugar (R-IN)

McCain (R-AZ)

McConnell (R-KY)

Moran (R-KS)

Paul (R-KY)

Portman (R-OH)

Risch (R-ID)

Roberts (R-KS)

Rubio (R-FL)

Sessions (R-AL)

Shelby (R-AL)

Thune (R-SD)

Toomey (R-PA)

Vitter (R-LA)

Wicker (R-MS)

Mark Kirk and James Inhofe did not vote. )

Early voting is happening in thirty states. Please get your absentee ballots now and vote. The tide is turning and we will defeat those who treat our Veterans and us, so contemptuously.

Reply With Quote

Reply With Quote

Bookmarks